Table of Contents

ToggleStartup Financial Planning: A Step-by-Step Guide

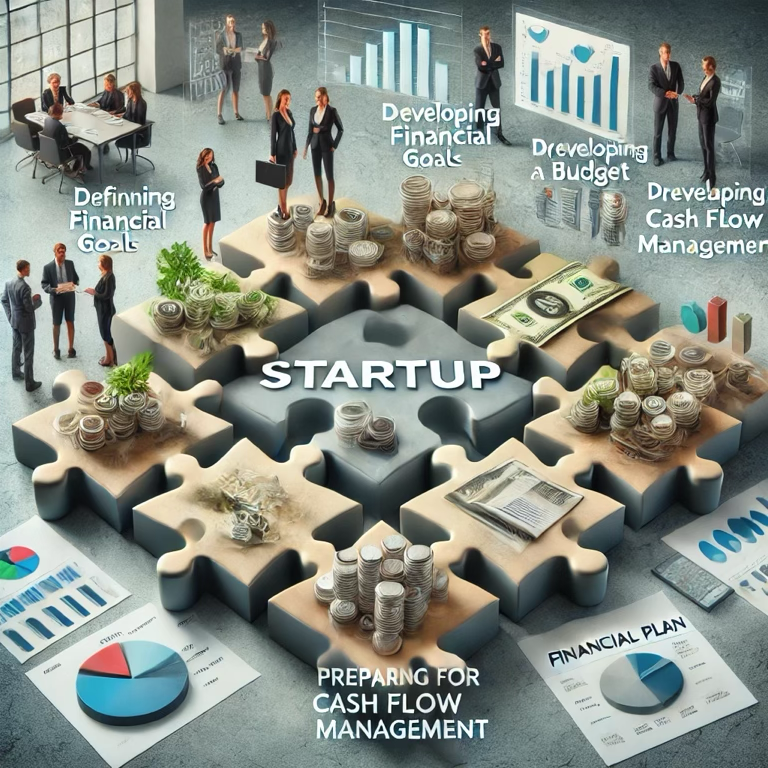

Starting a new business is an exciting journey filled with endless possibilities and dreams. However, one of the most critical aspects of ensuring your startup’s success is creating a robust financial plan. Think of your financial plan as a puzzle, where each piece is crucial to forming the complete picture of your startup’s success. In this guide, we’ll walk you through the essential steps to develop a comprehensive financial plan for your startup, focusing on startup financial planning and cash flow management for startups.

Why You Need a Financial Plan

Before diving into the steps, it’s essential to understand why a financial plan is crucial for your startup. Each piece of your financial plan puzzle plays a vital role in building a successful business:

- Provides a clear roadmap for your business

- Helps you manage and allocate resources efficiently

- Identifies potential financial challenges and opportunities

- Enhances your ability to attract investors and secure funding

Ready to piece together your startup’s success?

Steps to Success:

Step 1: Define Your Financial Goals

The first piece of your puzzle is defining your financial goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, you might aim to achieve a certain revenue target within the first year, reduce costs by a specific percentage, or break even by the end of the second year.

Having clear financial goals provides direction and purpose for your business activities. It helps you stay focused and motivated, knowing exactly what you are working towards. Additionally, well-defined goals make it easier to track your progress and make necessary adjustments along the way.

Step 2: Create a Budget

A budget is the cornerstone piece of your financial plan puzzle. It outlines your expected income and expenses over a specific period. Start by listing all your startup costs, including initial investments, operational expenses, and any other costs associated with running your business. Then, estimate your projected income based on market research and sales forecasts. This will give you a clear picture of how much money you need to get started and sustain your operations.

Creating a detailed budget helps you allocate resources efficiently and avoid overspending. It allows you to identify areas where you can cut costs and prioritize essential expenses. By sticking to your budget, you can maintain financial discipline and ensure that your startup remains financially healthy.

Step 3: Develop Financial Projections

Financial projections are the next critical pieces of your puzzle. These are estimates of your business’s future financial performance, typically including income statements, balance sheets, and cash flow statements for the next three to five years. Financial projections help you anticipate future revenues, expenses, and profitability, enabling you to make informed decisions and plan for growth.

Accurate financial projections are crucial for attracting investors and securing funding. They demonstrate your business’s potential for success and provide a clear picture of your financial health. Additionally, financial projections allow you to identify potential financial challenges and take proactive measures to address them.

Step 4: Plan for Cash Flow Management

Effective cash flow management for startups is another essential piece of your financial plan puzzle. It is crucial for maintaining liquidity and ensuring that you have enough cash to cover your expenses. Monitor your cash flow regularly to track your inflows and outflows. Identify periods when you might face cash shortages and plan accordingly. Implement strategies such as invoicing promptly, managing inventory efficiently, and negotiating favorable payment terms with suppliers.

By managing your cash flow effectively, you can avoid cash shortages that could jeopardize your business operations. It helps you maintain financial stability and ensures that you have the necessary funds to meet your financial obligations. Additionally, good cash flow management enhances your ability to invest in growth opportunities and scale your business.

Step 5: Prepare for Contingencies

No matter how well you plan, unforeseen circumstances can arise. It’s vital to prepare for contingencies by setting aside a reserve fund. This fund will act as a financial buffer, allowing you to navigate through unexpected challenges without jeopardizing your business operations.

Having a contingency plan provides peace of mind and ensures that your startup can weather financial storms. It allows you to handle emergencies and unexpected expenses without disrupting your business operations. By being prepared for contingencies, you can protect your business from financial setbacks and ensure long-term success.

Step 6: Track and Review Your Financial Plan

A financial plan is not a one-time document but a dynamic tool that needs regular monitoring and updating. Track your actual financial performance against your projections and make necessary adjustments. Regular reviews will help you stay on top of your finances, identify any deviations, and take corrective actions promptly.

By continuously monitoring and updating your financial plan, you can ensure that your business remains on track to achieve its financial goals. It allows you to adapt to changing market conditions and make informed decisions that drive growth and profitability. Regular reviews also provide valuable insights into your business’s financial health and performance.

Creating a financial plan for your startup may seem daunting, but it’s an essential step in building a successful business. By following these steps and focusing on startup financial planning and cash flow management for startups, you can piece together a solid financial foundation. Remember, a well-thought-out financial plan is not just about numbers; it’s about ensuring the long-term success and sustainability of your startup. So, take the time to plan meticulously and watch your business thrive

Why Figgie’s Finance?

At Figgie’s Finance, we specialize in providing comprehensive financial planning services tailored to your startup’s unique needs. Our team of experts helps you define clear financial goals, create detailed budgets, develop accurate financial projections, and manage cash flow effectively. By partnering with us, you gain peace of mind knowing your financial strategy is in expert hands.

Building a strategic financial plan not only sets the foundation for your startup’s growth but also ensures that you are prepared for any financial challenges that may arise. Contact Figgie’s Finance and schedule a free consultation to learn more about how we can assist you in navigating the complexities of startup financial planning.

Additional Resources

For further assistance in managing your business finances and building business credit, consider using the following tools:

• QuickBooks: A powerful accounting software to help manage your business finances.

• 1Password: Securely store and manage your business passwords and sensitive information.