Table of Contents

ToggleBookkeeping for Sole Proprietors: Industry-Wide Benefits

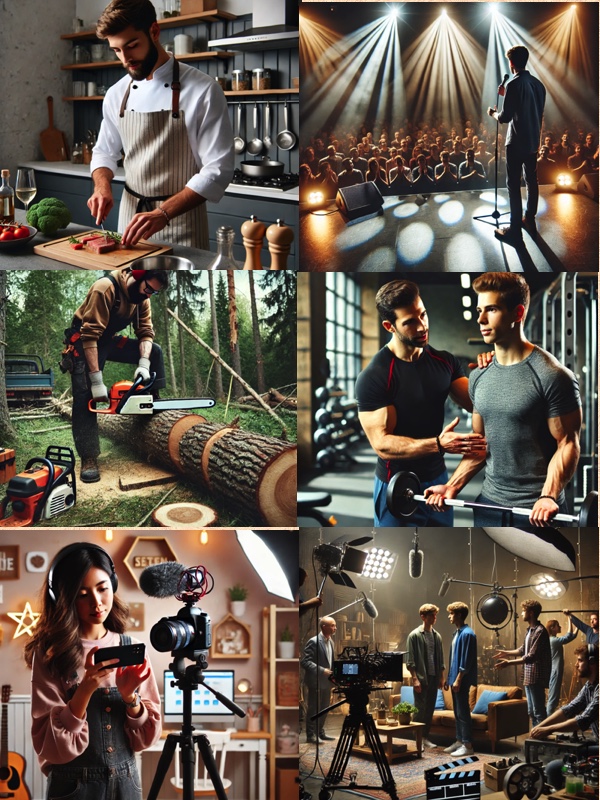

Running a sole proprietorship is a fulfilling venture, whether you’re a personal trainer, private chef, actor, comedian, contractor, or any other professional. However, managing your own business also comes with its share of challenges, particularly when it comes to finances. This is where bookkeeping for sole proprietors becomes invaluable. Bookkeeping accountants step in as invaluable allies, offering essential accounting services for entrepreneurs. Here’s how they can help streamline operations and drive success across various professions:

Bookkeeping for Personal Trainers

As a personal trainer, your focus is on helping clients achieve their fitness goals. Managing your finances shouldn’t distract from that mission. Bookkeeping accountants can help by:

• Tracking income and expenses, ensuring accurate financial records.

• Managing invoicing and payments, so you get paid on time.

• Handling tax deductions related to business expenses like equipment and travel.

Bookkeeping for Private Chefs

For private chefs, balancing the books while creating culinary masterpieces can be daunting. Here’s how bookkeeping accountants assist entrepreneurs:

• Keeping detailed records of ingredient purchases and event expenses.

• Managing invoices and payments for your services.

• Assisting with tax preparations, including deductions for travel, equipment, and marketing expenses.

Bookkeeping for Actors and Comedians

The entertainment industry is rife with fluctuating incomes and unique tax situations. Bookkeeping for sole proprietors, like actors and comedians, involves:

• Tracking income from various gigs, ensuring all earnings are recorded.

• Handling deductions for costumes, travel, and other work-related expenses.

• Preparing for tax season by organizing receipts and relevant documents.

Bookkeeping for Contractors

Contractors often juggle multiple projects and expenses. Bookkeeping accountants simplify financial management by:

• Tracking project-specific expenses and income.

• Managing payroll for any subcontractors or employees.

• Ensuring compliance with tax regulations and maximizing deductions.

Bookkeeping for Tree Removal Services

Tree removal businesses deal with significant equipment and labor costs. Bookkeeping for sole proprietors in this field includes:

• Tracking expenses for equipment, maintenance, and payroll.

• Managing invoicing and payments from clients.

• Assisting with tax preparations, including specialized deductions.

Bookkeeping for Musicians

Musicians often have varied income streams and expenses. Bookkeeping accountants can:

• Track income from performances, royalties, and merchandise sales.

• Manage deductions for travel, instruments, and studio time.

• Organize finances to simplify tax filing and ensure compliance.

Bookkeeping for Dog Walkers

Dog walkers might face irregular income and numerous small expenses. Bookkeeping accountants assist by:

• Tracking income and expenses for each client.

• Managing invoicing and ensuring timely payments.

• Preparing financial reports to simplify tax filing.

Bookkeeping for Carpenters

Carpenters, with their mix of materials and labor costs, can benefit from bookkeeping accountants by:

• Tracking expenses for materials and tools.

• Managing payroll for any assistants or subcontractors.

• Preparing financial statements and handling tax filings.

Bookkeeping for Content Creators and Influencers

In the digital age, content creators and influencers manage diverse income sources. Bookkeeping accountants help by:

• Tracking income from sponsorships, ad revenue, and merchandise sales.

• Managing expenses related to content creation, such as equipment and marketing.

• Ensuring proper tax filings and maximizing deductions.

The Bottom Line for Entrepreneurs

No matter your profession, accurate financial management is crucial for the success of your sole proprietorship. Bookkeeping for sole proprietors offers the expertise and support needed to keep your finances in order, allowing you to focus on what you do best. By partnering with a skilled bookkeeping accountant, you can ensure your business thrives in a competitive market.

For professional bookkeeping and accounting services tailored to your unique business needs, contact Figgie’s Finance. Let us help you manage your finances, so you can focus on growing your business.

At Figgie’s Finance, your success is our priority!

Additional Resources

For further assistance in managing your business finances and building business credit, consider using the following tools:

• QuickBooks: A powerful accounting software to help manage your business finances.

• 1Password: Securely store and manage your business passwords and sensitive information.