Table of Contents

ToggleThe Future of Virtual Accounting: Emerging Trends and Technologies

Welcome to the future of accounting, where virtual accountants are not just number crunchers but your financial wizards, equipped with cutting-edge technology to transform your business. As we dive into the world of tomorrow, let’s explore the emerging technologies revolutionizing virtual accounting and the thrilling predictions for the industry. Buckle up, and let’s embark on this exciting journey!

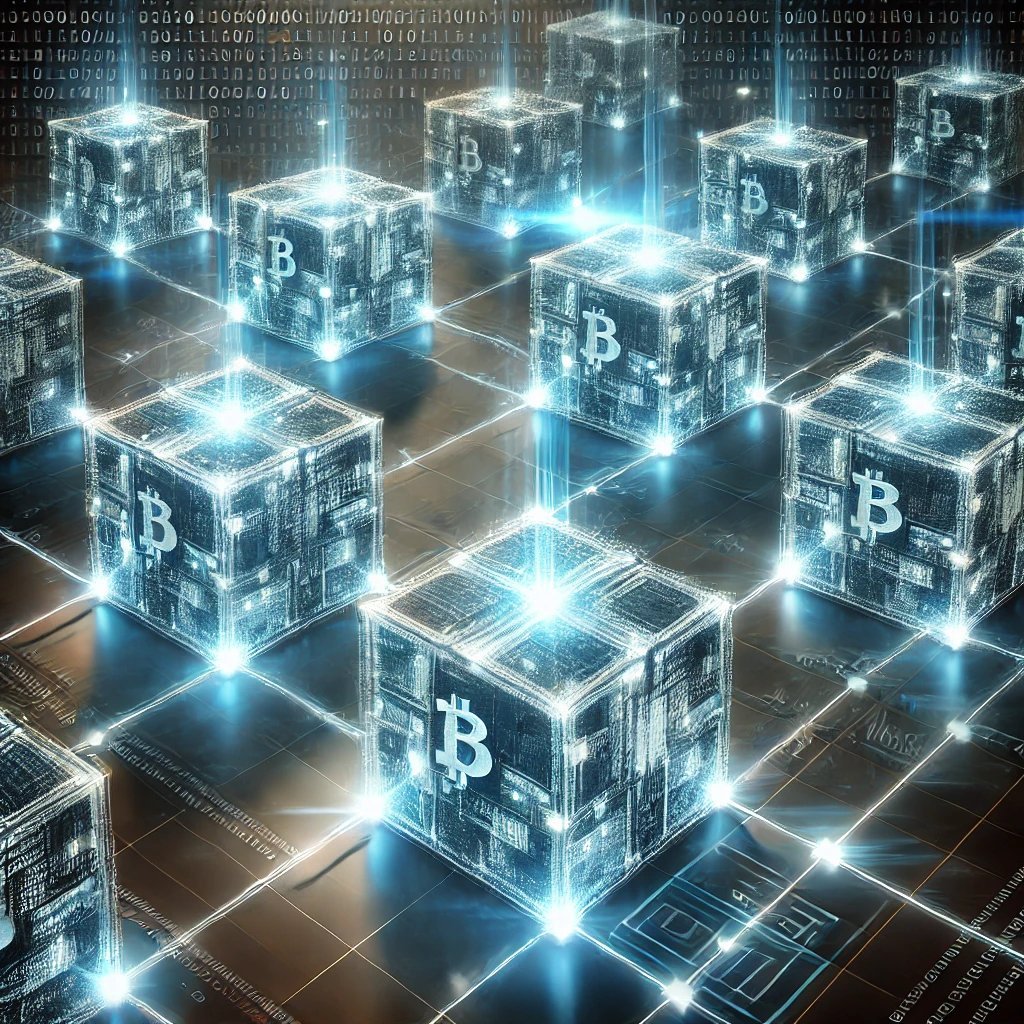

Blockchain: The Trustworthy Ledger

In the futuristic world of accounting, transparency and security are paramount. Enter blockchain accounting.

Imagine a digital ledger where every transaction is securely recorded and easily traceable. Smart contracts automate and enforce the terms of agreements, reducing administrative overhead. With real-time auditing, blockchain ensures your financial records are always up-to-date and tamper-proof. Say goodbye to sleepless nights worrying about fraud and hello to peace of mind.

Cloud Computing: Accounting Anytime, Anywhere

Gone are the days of being tied to a desk. With cloud-based accounting, you can access your financial data anytime, anywhere. Whether you’re sipping a latte at a café or attending a conference in Tokyo, your virtual accountant is always with you. The scalability of cloud solutions means they grow with your business, offering flexibility and cost-efficiency. Collaboration has never been easier, making cloud computing a game-changer for modern businesses.

Big Data: Unlocking Financial Insights

Imagine having a crystal ball that gives you insights into your business’s financial health. That’s the power of big data in accounting. By analyzing vast amounts of data, virtual accountants can uncover trends, identify opportunities, and provide data-driven insights. Customizable dashboards let you track key performance indicators (KPIs) in real-time, giving you a clear picture of where your business stands and where it’s headed. This is data-driven decision making at its finest.

Robotic Process Automation (RPA): Efficiency Unleashed

Think of robotic process automation (RPA) as your tireless, ever-efficient assistant. RPA can handle complex processes like payroll processing and compliance reporting with ease and consistency. By automating these tasks, your virtual accountant can focus on what they do best—providing strategic financial advice and helping you grow your business. This is the future of efficiency.

Predictions for the Future of Accounting

So, what does the future hold for the accounting industry? Here are some exciting predictions:

Increased Adoption of Virtual Accounting: As businesses embrace remote work, the demand for virtual accounting services will soar. Cost savings, flexibility, and access to specialized expertise will drive this trend.

Rise of Niche Accounting Services: Expect to see more virtual accountants specializing in areas like cryptocurrency accounting, environmental accounting, and forensic accounting. These niche services will cater to the evolving needs of businesses.

Integration of Advanced Technologies: The synergy of AI, blockchain, and other advanced technologies will continue to transform accounting practices, making them more efficient, secure, and insightful.

Shift Towards Advisory Services: With routine tasks automated, virtual accountants will focus more on advisory roles, offering strategic financial advice and business consulting. This shift will make accountants more valuable than ever.

Enhanced Data Security and Privacy: As cyber threats evolve, virtual accounting firms will invest in advanced security measures to protect client data. This ensures that your financial information is always safe and secure.

Globalization of Accounting Services: Virtual accounting will break geographical barriers, enabling firms to serve clients worldwide. This global reach will foster international collaboration and growth.

Continuous Learning and Adaptation: Accountants will need to keep up with technological advancements and regulatory changes through continuous professional development. This ensures that they remain at the forefront of the industry.

Final Thoughts: Embrace the Future with Figgie’s Finance

The future of virtual accounting is bright and full of possibilities. At Figgie’s Finance, we are at the forefront of incorporating these emerging technologies to enhance our operations. By leveraging advancements such as AI, blockchain, and cloud computing, we increase our efficiency and accuracy, allowing us more time to focus on what truly matters—serving our clients better.

As routine tasks become automated, our virtual accountants are able to shift towards more advisory roles. This means we can provide even more strategic financial advice and business consulting services, becoming a vital asset to your business’s success. Our commitment to integrating cutting-edge technology enables us to offer superior financial insights and guidance.

Whether you’re a tech-savvy entrepreneur or a traditional business owner, the futuristic world of virtual accounting through Figgie’s Finance is ready to transform your financial landscape.

Are you ready to step into the future with a virtual accountant by your side? Contact us today to see how we can help your business thrive in this exciting new era. At Figgie’s Finance, Your Success is Our Priority!

Additional Resources

For further assistance in managing your business finances and building business credit, consider using the following tools:

• QuickBooks: A powerful accounting software to help manage your business finances.

• 1Password: Securely store and manage your business passwords and sensitive information.