Table of Contents

ToggleWhy Paying Yourself First is Essential for Business Success

Have you ever heard wealthy people like Robert Kiyosaki use the term “paying yourself first” and wondered what it meant? Or even thought to yourself, “Well, that just seems selfish”? This principle may sound greedy and selfish at first, but once you understand the concept in depth, you will see how this key principle is the foundation behind how the wealthy can navigate some of the hardest conditions and times while staying completely relaxed and composed.

The concept of ‘paying yourself first’ is a fundamental financial strategy, especially significant for business owners and entrepreneurs. This principle involves setting aside a portion of your income for personal savings and investments before addressing business expenses and other financial obligations. This approach ensures personal financial stability, providing a buffer against unexpected personal or business expenses.

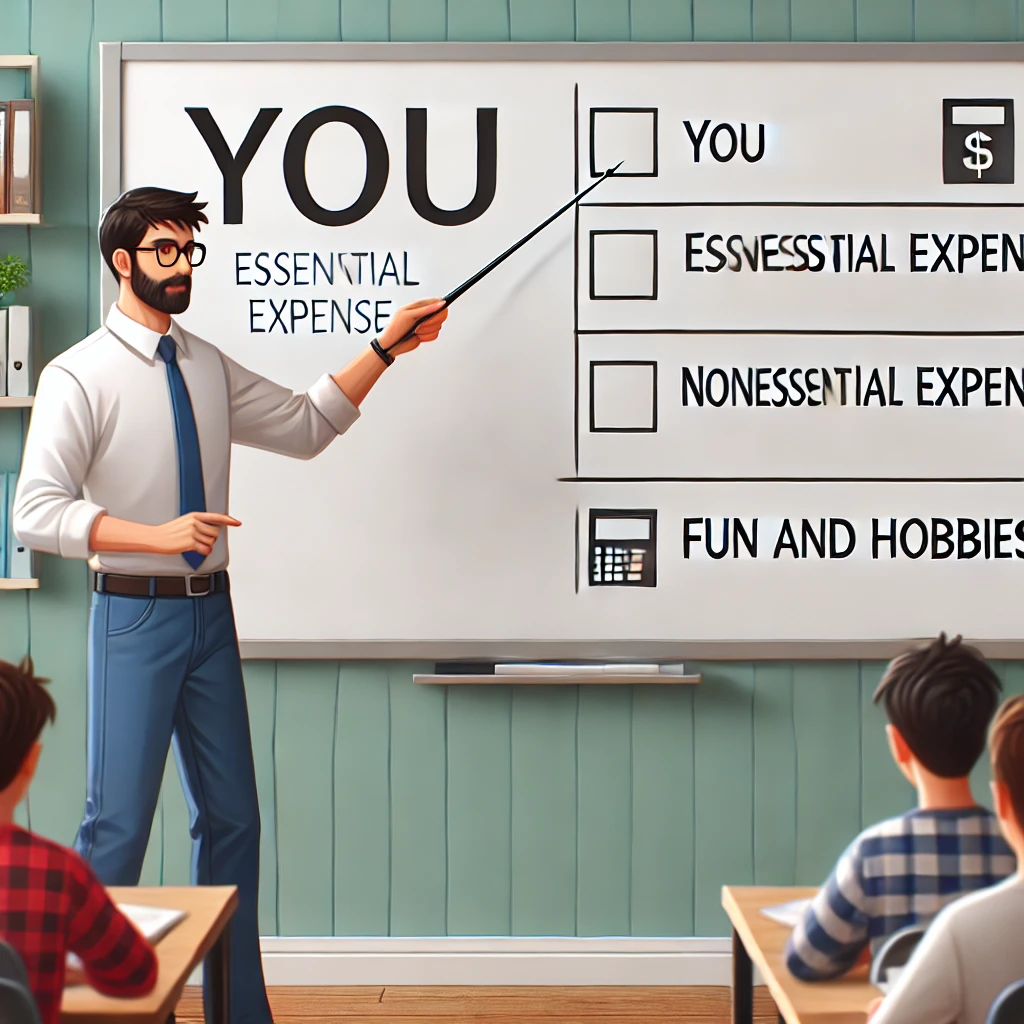

In life, we have many expenses that are necessary to maintain our basic standards of living, such as mortgages, utility bills, car payments, and insurance. These expenses have become so important to us that most people prioritize them as the most important expenses. However, in truth, YOU are the most important and should always be YOUR first priority.

Changing your mental thought process to prioritize paying yourself first before those expenses is one of the most common practices among the wealthy and successful.

Why It’s Beneficial and Strategic

1. Building Financial Security

Prioritizing personal savings and investments creates a financial safety net. This is crucial for handling unexpected expenses, allowing you to make confident decisions and take calculated risks that benefit your business in the long run.

2. Encouraging Financial Discipline

Allocating a specific percentage of income to personal savings instills disciplined financial habits, ensuring that saving becomes a priority rather than an afterthought. This leads to more prudent financial management both personally and professionally.

3. Reducing Stress

Ensuring a regular income reduces financial anxiety, allowing you to focus more on growing your business. Recognizing your hard work through regular payments can also be a great motivator.

4. Motivating Business Growth

Paying yourself first serves as a tangible motivator, linking your business success directly to personal financial gain. This drives you to set and achieve higher business goals, fostering continuous improvement and innovation.

Financial educator and author Robert Kiyosaki, known for “Rich Dad Poor Dad,” is a strong advocate of paying yourself first and investing money to combat the impact of inflation on cash sitting in a bank account.

Effective Strategies for Implementing ‘Pay Yourself First’

1. Set Clear Financial Goals

Determine how much to set aside each month for retirement savings, emergency funds, and personal salary. Clear objectives provide a roadmap for earnings allocation, ensuring prioritization of long-term financial health.

2. Automate Your Savings

Set up automatic transfers from your business account to personal savings to eliminate the temptation to spend those funds elsewhere. Automation applies to retirement accounts, emergency funds, and other financial goals.

3. Prioritize Essential Expenses

Cover essential expenses such as mortgage, insurance premiums, and car payments before addressing non-essential expenses. This safeguards financial stability and reduces stress.

4. Manage Non-Essential Expenses Distinguish between necessary and discretionary spending. Minimizing discretionary spending allows more funds to be directed towards essential financial goals and business growth.

5. Wisely Allocate Leftover Funds

Use leftover funds for personal enjoyment or reinvestment into your business. This might include updating software, attending industry conferences, or exploring new marketing strategies, driving further growth and securing a stronger financial future.

Now this may sound like a boring approach and leaves no room for “Fun Money”, but you will begin to see how when you invest your money rather than spend your money eventually you will end up with more money than you will know what to do with. This is the beginning signs of financial prosperity

Example of Prioritizing Expenses

Consider Xavier, a successful entrepreneur running a small personal trainer business. He allocates a portion of his income towards his Roth IRA contributions, an investment portfolio and life insurance premiums. This is an example of Xavier paying himself first before his essential expenses like mortgage payments, car payments and utilities. After covering essential expenses, he budgets for non-essential items like streaming services, dining out, and spa treatments. Any remaining funds are used for personal enjoyment or reinvested into his business. Xavier’s disciplined approach exemplifies the ‘paying yourself first’ strategy, ensuring both personal and professional financial health.

By adopting this principle, you can secure your financial future while fostering business growth. Figgie’s Finance is here to help business owners and entrepreneurs implement these tips into their lives and businesses. Contact us today to see how we can assist you on this financial journey. Your Success Is Our Priority!

Additional Resources

For further assistance in managing your business finances and building business credit, consider using the following tools:

• QuickBooks: A powerful accounting software to help manage your business finances.

• 1Password: Securely store and manage your business passwords and sensitive information.