Table of Contents

ToggleCommon Financial Mistakes: Top 8 Tips for Business Owners

Running a business involves juggling multiple responsibilities, and managing finances is one of the most critical tasks. However, even the most diligent business owners can make common financial mistakes that may lead to significant consequences. At Figgie’s Finance, we’ve seen firsthand how these errors can impact a business. In this blog post, we’ll identify some of the most common financial mistakes businesses make and provide practical advice on how to avoid them.

Poor Cash Flow Management

Mistake: Many businesses fail to monitor their cash flow effectively, leading to liquidity issues and potential insolvency.

Solution: Implement robust cash flow management strategies. Regularly review your cash flow statements to track incoming and outgoing cash. Forecast future cash flows to anticipate potential shortfalls and take proactive measures to address them. Using accounting software can automate this process and provide real-time insights.

Neglecting to Create a Budget

Mistake: Operating without a budget can lead to overspending and financial instability.

Solution: Develop a detailed budget that outlines expected revenues and expenses. Review and adjust your budget regularly to reflect changes in your business environment. A budget acts as a financial roadmap, helping you allocate resources efficiently and stay on track with your financial goals.

Mixing Personal and Business Finances

Mistake: Combining personal and business finances can lead to inaccurate bookkeeping and complicate tax filings.

Solution: Open separate bank accounts and credit cards for your business. This separation simplifies tracking business expenses and income, ensures accurate financial records, and makes tax preparation more straightforward. It also helps establish your business as a distinct legal entity, which is essential for legal and tax purposes.

Ignoring Accounts Receivable

Mistake: Failing to follow up on outstanding invoices can result in cash flow problems and lost revenue.

Solution: Implement a system for tracking and managing accounts receivable. Set clear payment terms and send invoices promptly. Follow up on overdue invoices with reminder emails or calls. Offering incentives for early payments or implementing late fees can also encourage timely payments.

Overlooking Tax Obligations

Mistake: Mismanaging tax obligations can lead to penalties, interest charges, and legal issues.

Solution: Stay informed about your tax responsibilities and deadlines. Consider working with a professional accountant or bookkeeper who can help you navigate tax regulations, ensure timely filings, and identify potential tax-saving opportunities. Setting aside funds for tax payments throughout the year can also prevent last-minute financial strain.

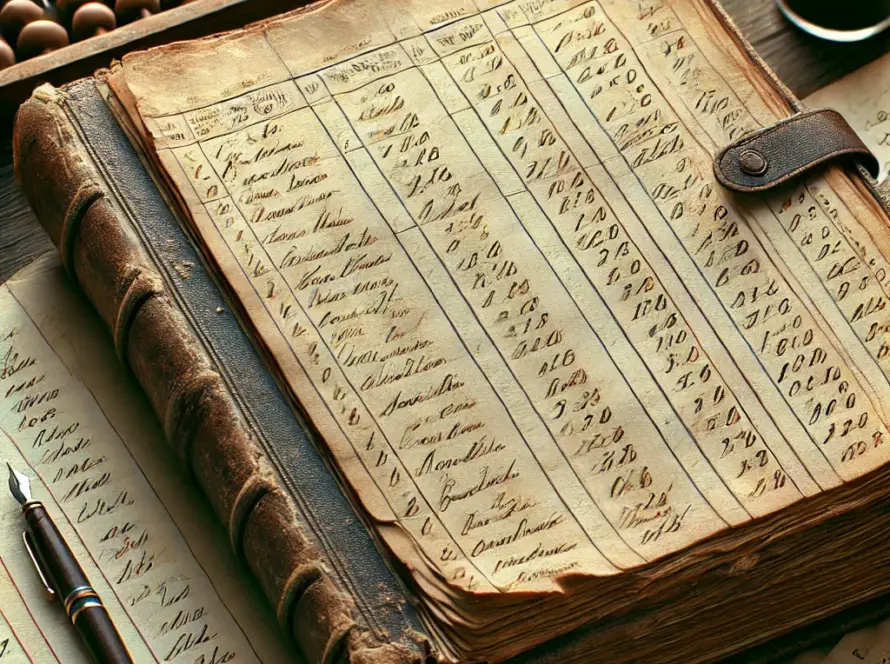

Failing to Track Expenses Accurately

Mistake: Inaccurate expense tracking can distort your financial picture and lead to budgeting errors.

Solution: Keep detailed records of all business expenses. Use accounting software or mobile apps to capture and categorize expenses in real time. Regularly review your expense reports to identify areas where you can cut costs and improve efficiency.

Lack of Financial Planning

Mistake: Operating without a long-term financial plan can hinder your business growth and sustainability.

Solution: Develop a comprehensive financial plan that includes goals, strategies, and timelines. Regularly review and update your plan to reflect changes in your business and the market. A financial plan helps you stay focused on your objectives and make informed decisions about investments, expansions, and other strategic initiatives.

Not Seeking Professional Help

Mistake: Attempting to handle all financial tasks without professional assistance can lead to errors and missed opportunities.

Solution: Partner with a professional accounting and bookkeeping firm like Figgie’s Finance. We offer expert guidance, ensure compliance with financial regulations, and provide valuable insights into your business’s financial health. Outsourcing these tasks allows you to focus on growing your business while ensuring your finances are in capable hands.

Avoiding these common financial mistakes can significantly enhance your business’s financial stability and success. By implementing best practices in cash flow management, budgeting, expense tracking, and seeking professional help, you can navigate the complexities of financial management for business owners with confidence. At Figgie’s Finance, we’re committed to helping you achieve financial clarity and success. Contact us today to learn more about how we can support your business’s financial needs.At Figgie’s Finance, your success is our priority!

Additional Resources

For further assistance in managing your business finances and building business credit, consider using the following tools:

• QuickBooks: A powerful accounting software to help manage your business finances.

• 1Password: Securely store and manage your business passwords and sensitive information.